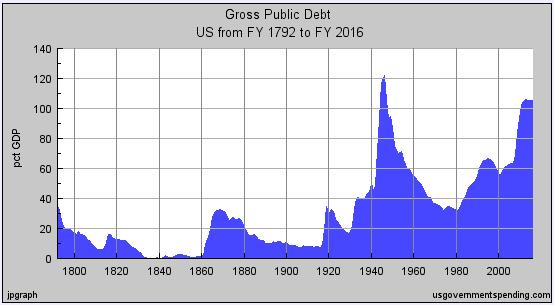

US Federal Debt

The US government debt reached above 100% of GDP for the second time in the US history following the 2008 credit crisis. By the end of 2011 US debt is expected to be $15.47 Trillion Dollars, or approximately 104% of GDP.

When the US government was created after the election of 1788 the federal debt was floated by the first Treasury Secretary, Alexander Hamilton. Hamilton stabilized the dollar and refunded the debts that stood at 35% of GDP. By the 1830s the Revolutionary war debt had been paid off—just in time for the Civil War when federal debt climbed back up to 33% of GDP. Still, the Civil War debt was pretty well paid off by the turn of the 20th century.

At the beginning of the 20th century debt was equally divided between federal and state and local debt, totaling less than 20 percent of GDP. After World War I, the federal debt surged to 35% of GDP. But by the mid 1920s federal debt had declined to below 20% of GDP with state and local debt rising to 16% of GDP. Then came the Great Depression, and President Roosevelt decided to spend his way out of trouble, boosting federal debt to 40% of GDP. Government debt, including federal and state and local debt rose to 70% of GDP by 1933. But it was World War II that really entered new territory. After the end of the war in 1946, federal debt stood at almost 122% of GDP, with state and local debt adding another 7% to total of 129% of GDP. For the next 35 years successive governments brought down the debt, but then came President Reagan. He increased the federal debt up over 50% of GDP to win the Cold War. President Bush increased the debt to fight a war on terror and bail out the banks. President Obama is increasing it to try overcoming the 2008 credit crisis.

Us Debt Ceiling

Article I Section 8 of the United States Constitution gives the Congress the sole power to borrow money on the credit of the United States. From the founding of the United States through 1917 Congress authorized each individual debt issuance separately. In order to provide more flexibility to finance the United States' involvement in World War I, Congress modified the method by which it authorizes debt in the Second Liberty Bond Act of 1917. Under this act Congress established an aggregate limit, or "ceiling," on the total amount of bonds that could be issued.

The modern debt limit, in which an aggregate limit was applied to nearly all federal debt, was substantially established by Public Debt Acts passed in 1939 and 1941. The Treasury has been authorized by Congress to issue such debt as was needed to fund government operations (as authorized by each federal budget) as long as the total debt (excepting some small special classes) does not exceed a stated ceiling. Since 1979, the House of Representatives by rule has automatically raised the debt ceiling when passing a budget, except when the House votes to waive or repeal this rule. By August 2nd 2011 the debt ceiling has be rose more than 70 times.

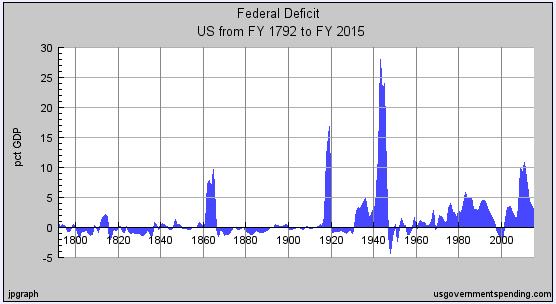

US Government Deficit

Today’s federal deficit is approximately 10% of GDP and is the third highest since US foundation. The peak deficits came during World War I (16% of GDP in 1919) and World War II (24% in 1945), as Chart 4 shows. The deficits of the Great Depression only came to about five percent of GDP.

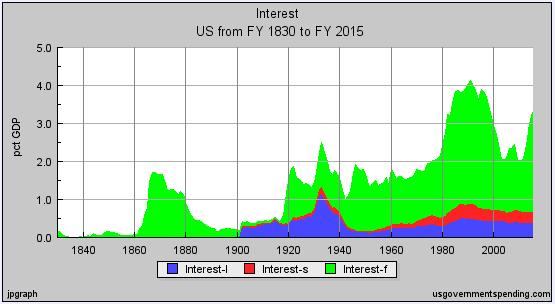

Interest Paid

The peak period for government interest payments, including federal, state, and local governments, was in the 1980s, when interest rates were still high after the inflationary 1970s. These days (2011) the US government interest rate paid as percentage of GDP is slightly more than 2% and expected to be approximately 3.5% in 2015. The real risk from government debt is the burden of interest payments. Experts say that when interest payments reach about 12% of GDP then a government will likely default on its debt.

Associated Risks

- Risk of Default

- Falling into Recession

- Rising Inflation

- Increasing Interest rates and narrowed ability to raise money